Detroit Expired LIHTC Conversion Project

Through the voices of community residents, both in interviews and personal journal reflections, this project explores the transition from renting to homeownership across two former LIHTC developments in Detroit. By collecting their experiences with credit, money management, household finances, and more, we will be able to recommend ways lenders can evaluate mortgage applications to make housing finance available to more families in Detroit and around the country.

LIHTC is an important policy tool to aid in the development of new single-family and multi-unit housing in Detroit. According to the 2021 ACS 5-Year Estimate, the median year of construction for residential units in Detroit is 1947. That means half of all housing in Detroit is nearly 80 years old. By spreading costs across multiple investors (who can then claim development costs as a tax credit), LIHTC both lowers the capital threshold for development projects and reduces financial risk. Numerous LIHTC developments exist across Detroit. This project considers the extent to which the presence of LIHTC developments improves the overall quality of the housing stock, thus making it easier for borrowers to obtain financing to purchase a home.

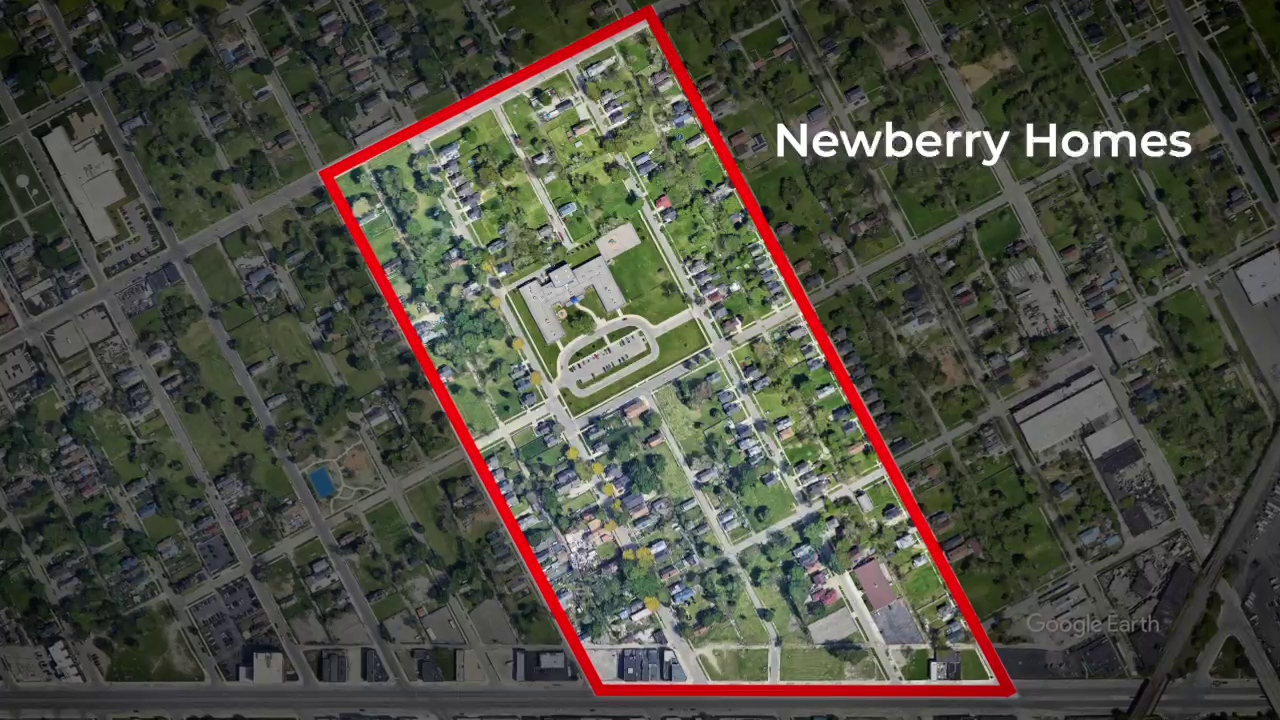

From a $2.5 million donation our community partner on this project, MiSide, worked with an area lender to capitalize a mortgage fund, the product of which was made available to residents of the Newberry Homes LIHTC development beginning in 2018. This financing gave Newberry residents the opportunity to own their homes. To date, 50 households have purchased Newberry homes. This project aims to convene stakeholders in Detroit housing finance to share lessons learned from this innovative mortgage product, including the experiences of Newberry homeowners.

This project was made possible through a $330,000 grant from the U.S. Department of Housing and Urban Development.

Project Goals

-

The Center For Equitable Family and Community Well-Being received $330,000 from the Department of Housing and Urban Development to close gaps in mortgage financing. The $330,000 award will focus on the role of specialized mortgage products to achieve homeownership for former low income housing renters.

-

The community partner on this project, MiSide (formerly Southwest Solutions) developed a mortgage product in 2018 to help the tenants of the Newberry Homes development in East Chadsey Condon, Detroit, purchase their residences. Importantly, these tenants would not have qualified for conventional mortgage financing, and this HUD research project will allow the partnership to delve deeper into the impact of homeownership by comparing Newberry residents to another cohort of low income housing renters who did not have access to similar mortgage products. The findings will allow the Center to examine how conventional approaches to determining creditworthiness overlook candidates that could afford and sustain homeownership.

Homeownership Reflections Journal

As an additional qualitative exercise, we're conducting a homeownership journal that encourages creativity and visioning. This innovative approach not only captures experiences but also fosters a space for envisioning and shaping future homeownership narratives within our community.

These journals feature 6 essential categories:

- Financial Decision Making

- Lender & Mortgage Experiences

- Trust & Community Bonds

- Futurism & Dreams

- Community Visionaries

- Personal & Global Visions